Account Benefits

No Maintenance Fee

Let your money work for

you without monthly fees

getting in the way.

FDIC Insured

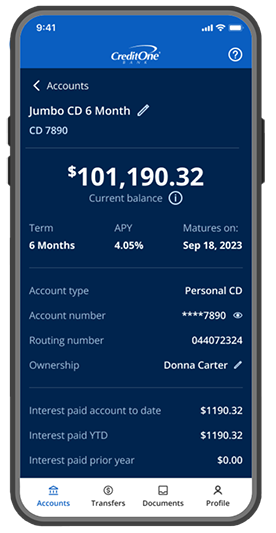

Easy Account Management

Managing your savings account

is simple with our website and

mobile app.

Ready to open an account?Get set up in just a few minutes

Create Your Online Profile

Signing up is quick and simple

Provide Your Information

We only need a few key pieces

of information.

Fund your account

Transfer from another bank account.

We've got answers to your questions

Are my deposits with Credit One Bank FDIC insured?

Yes. Credit One Bank is an FDIC member, FDIC Certificate Number 25620, meaning funds deposited with Credit One Bank are insured up to the maximum allowed by law. Generally, the FDIC insures deposits held at the same financial institution according to the account’s ownership category of up to $250,000 for all individually owned accounts combined, $250,000 per owner in jointly-owned accounts combined, and up to $250,000 per beneficiary on revocable trust (Payable on Death) type accounts. The FDIC insures deposits according to ownership category with current maximums.

What are my options when my Jumbo Certificate of Deposit reaches maturity?

Your account defaults to auto-renewal at maturity, but you have the option of logging into your account online and selecting your maturity preferences in advance of your Jumbo Certificate of Deposit (CD) maturing. We also provide a 10-day grace period starting at your CD maturity date in which you may renew your CD, move your funds into a new CD with a different term, add funds, or close and withdraw your funds.

If your CD does not have an auto-renewal option selected, the account will close on maturity.

How do I make a deposit to my Jumbo High Yield Savings Account?

You can make a deposit to your Jumbo High Yield Savings Account by scheduling a transfer from your linked external bank account through online banking or our mobile app.

Not a deposit customer?

Get help with a credit card account.

† Rates subject to change. Fees may reduce earnings.

1 Receive a .05% Loyalty Rate increase when you have both a Jumbo High-Yield Savings account and a Jumbo Certificate of Deposit account with us. The Loyalty Rate increase is subject to change and may be discontinued at any time. Please see our FAQs for additional information.