What Is the Highest Credit Score Possible and How To Get It

September 12, 2025

Topics:

Credit ScoreMost people will never get the highest possible credit score, but some do manage to attain what seems unattainable. This is how they do it.

Introduction

Your credit score influences nearly every major financial step you take. Whether you’re applying for a mortgage, shopping for a new car, or trying to secure a top-tier credit card, your score plays a starring role. It demonstrates your reliability to lenders when borrowing money.

If you’re competitive, you might set out to snag the highest of high scores … even a perfect score, if you can get it. But for many people, aiming for the best score possible feels like trying to climb Mount Everest — a desirable goal that’s complicated to undertake and difficult to achieve.

Let’s break down what the highest credit score looks like, how it works, and what steps you can take to reach it.

Understanding the Maximum Credit Score

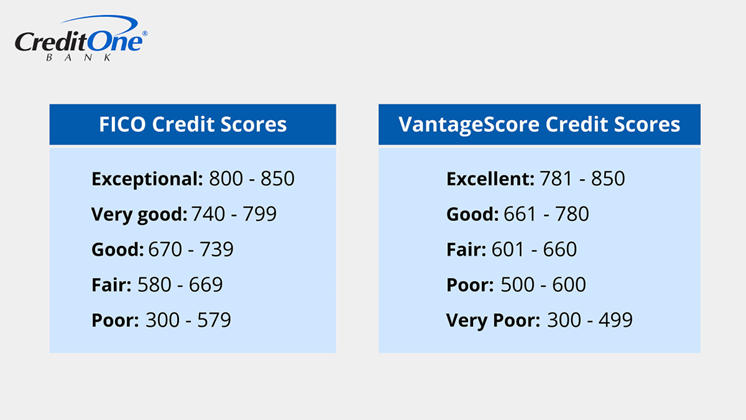

The highest credit score possible depends on the scoring model you use. However, for the most popular models of both FICO and VantageScore — the two primary scoring systems in the credit industry — the maximum credit score is 850. Hitting that number means your credit habits are virtually flawless.

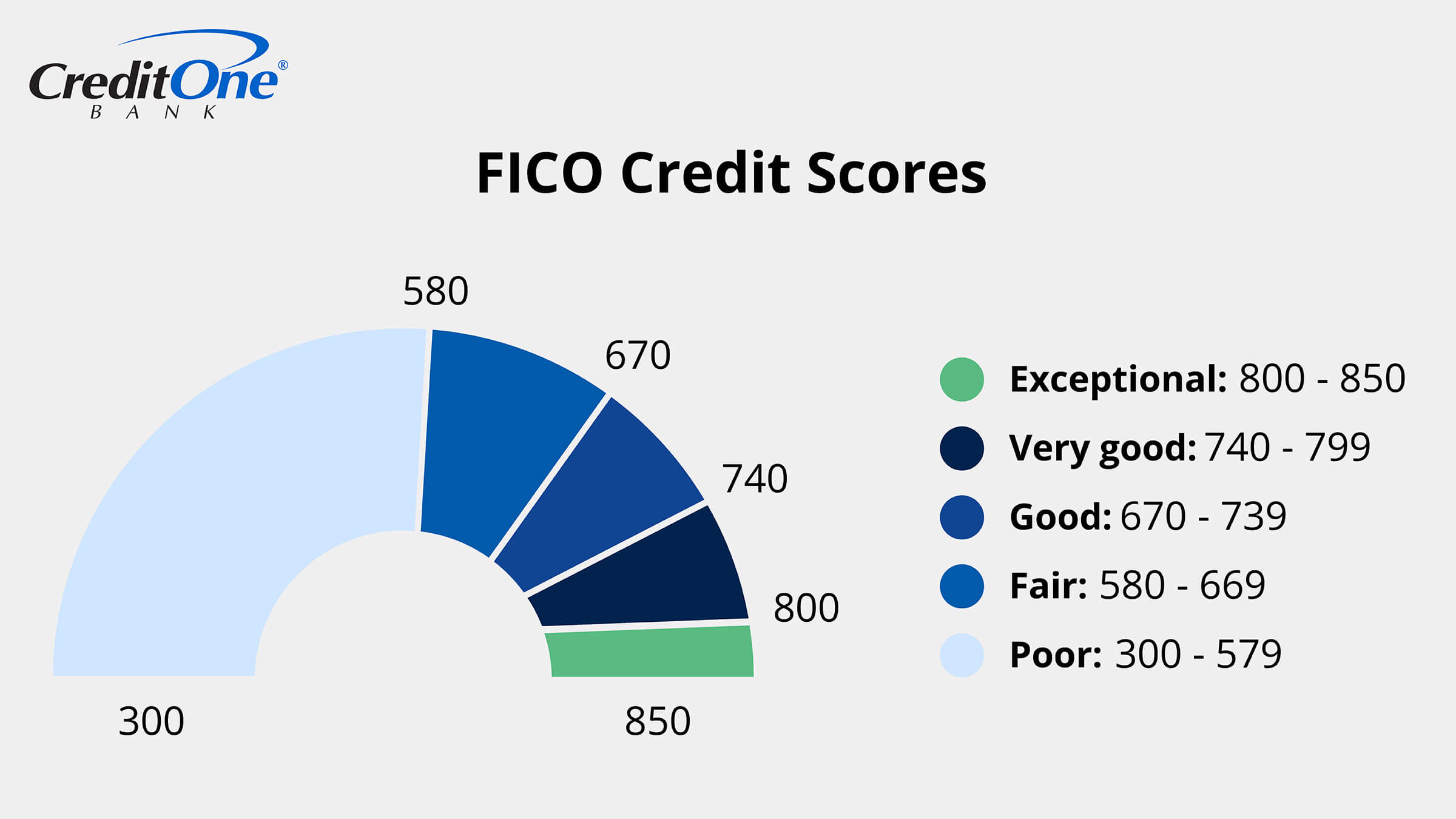

The ranges of credit scores typically look like this for FICO:

- Poor: 300–579

- Fair: 580–669

- Good: 670–739

- Very good: 740–799

- Exceptional: 800–850

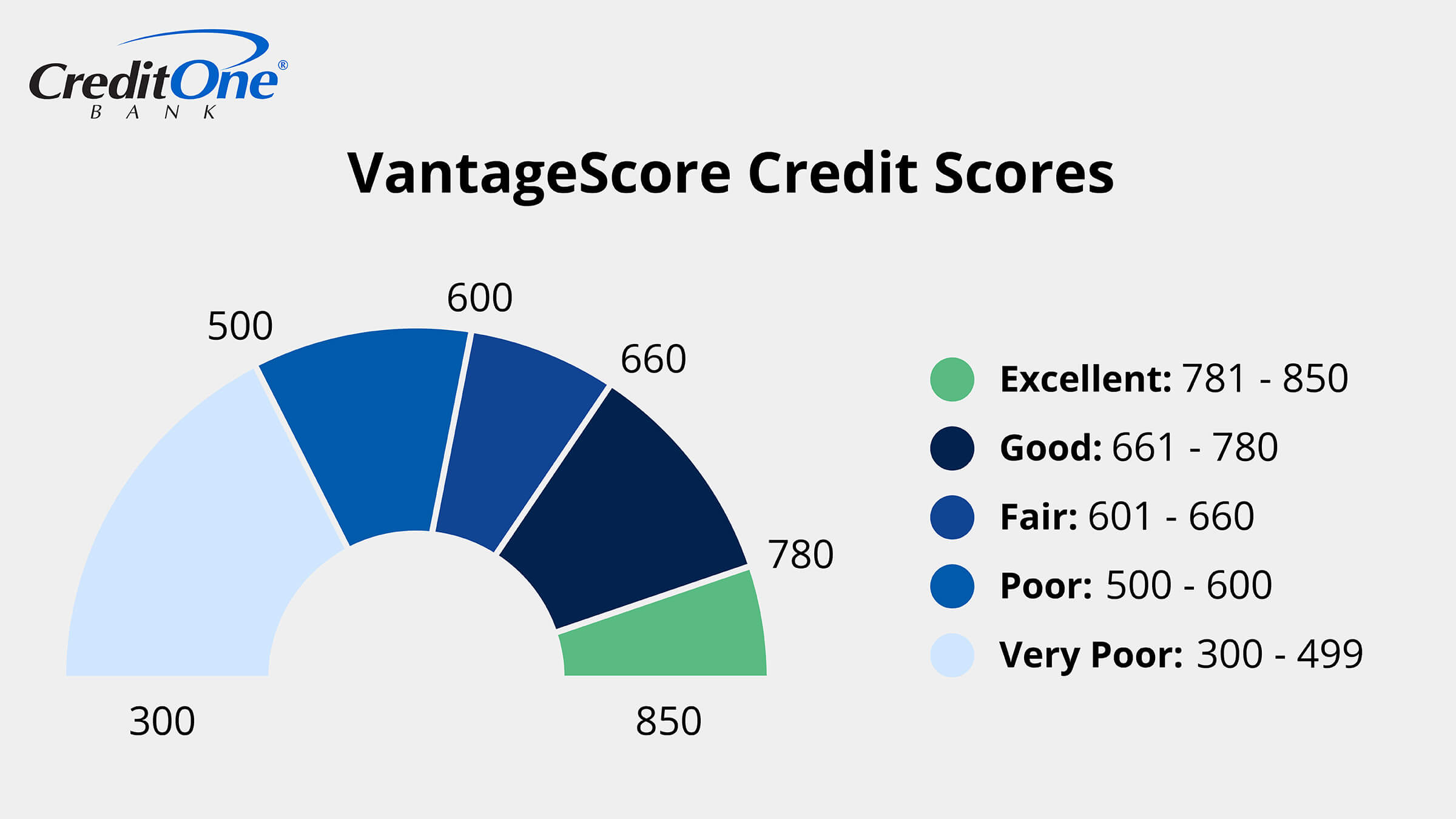

VantageScore 3.0 has a similar breakdown:

- Very poor: 300–499

- Poor: 500–600

- Fair: 601–660

- Good: 661–780

- Excellent: 781–850

What the Max Credit Score Means for You

Reaching the max credit score isn’t just a badge of honor — it can also unlock some of the best financial perks available. Lenders are more likely to approve your applications quickly and offer you lower interest rates, which saves money over time. And you may qualify for higher limits and better benefits with credit cards.

Still, you don’t need a perfect 850 to enjoy elite perks. Many lenders treat scores above 760 the same way they’d treat a perfect score. The reason most people don’t reach the top is that scoring systems factor in variables such as the age of accounts and total debt. Even if you’re financially responsible, small things like closing an old credit card or applying for new credit can shave off a few points.

We should also acknowledge that lenders don’t base all of their lending decisions just on credit scores. Your income, debt-to-income ratio, and employment history can all influence the final decision. So a great credit score strengthens your position, but it works best when paired with a stable financial background.

Credit Score Variations and Models

Even though you might think of your credit score as one firm number, you actually have multiple credit scores — not just one.

In fact, you can have dozens of credit scores, because different models calculate scores in different ways.

So your FICO Score 8 likely won’t be the same as your VantageScore 3.0, and both might differ from the scores your auto lender sees. The exact number depends on the scoring model being used and the data the lender pulls.

The number also changes depending on which credit bureau reports the information. Experian, Equifax, and TransUnion all collect slightly different data and use unique reporting methods. All those factors help shape your credit profile, and ultimately your credit score.

A Good Score vs the Maximum Credit Score

There’s a significant difference between a strong credit score and the highest credit score. Lenders think of credit scores as tiers. Once your score climbs into the high 600s, you’re seen as a lower-risk borrower.

As you continue improving your credit habits, you can reach the “very good” or even “excellent” range, where better loan terms, lower interest rates, and premium credit card offers become more accessible. While those numbers vary slightly by model, the principle stays the same — when you’re in the excellent range, lenders trust you.

If you’d still like to go for that elusive score of 850, be aware that it requires time and consistency. It’s not just about making payments on time … every small piece of your financial picture needs to line up consistently and accurately.

Habits That Can Help You Reach the Highest Credit Score

Strong credit comes from regularly established habits, like paying every bill on time without fail. Even a single late payment can significantly harm your credit score, reducing your chances of qualifying for the best rates and terms.

Next, focus on keeping your credit utilization ratio low — under 30% is a common recommendation, but the lower the better. And leave your oldest credit cards active because a longer credit history can help your score.

You’ll also want to minimize hard inquiries on your credit profile. If you apply for multiple loans or credit cards within a short timeframe, it raises flags. And it’s a good idea to check your credit reports regularly for any inaccuracies.

Another helpful tip is using different types of credit instead of focusing on just one. Having a diverse mix, such as a credit card, a student loan, or an auto loan, can show lenders you’re capable of managing various forms of debt. Just make sure you’re not taking on more than you can handle.

Implementing each of these credit score improvement practices will help raise and protect your score.

Myths About the Maximum Credit Score

You’ll likely hear many myths about perfect credit scores. Some people think you need a score of 850 to secure the best deals. Others think checking your score will hurt it — but neither is true.

In reality, most financial institutions don’t treat an 850 score any better than an 800. And checking your score through a credit monitoring service is considered a “soft inquiry,” which doesn’t impact it at all. The idea that carrying a small balance boosts your score is another myth. You can pay off your credit cards in full and still maintain an excellent credit rating.

It’s also false that your income directly affects your credit score. While lenders do consider income during the approval process, credit scoring models don’t include it. Your score is based solely on how you manage credit, not on your income.

Tips To Maintain a High Credit Score Over Time

Once you’ve built a high credit score, the goal becomes maintaining it. Staying consistent with good financial habits is the best strategy for long-term credit health.

Following these tips can help keep you on track:

Automate your payments so you don’t miss any due dates, even accidentally.

Monitor your balances regularly and consider making mid-cycle payments if your utilization starts to increase.

Keep older accounts open to preserve the length of your credit history.

Be strategic with new credit, limit how often you apply, and group rate-shopping inquiries into a short time frame.

Review your credit reports regularly to identify and correct errors promptly.

Avoid unnecessary hard inquiries that can cause small score drops over time.

Set annual credit goals, such as lowering total debt or improving your utilization ratio.

These small but consistent efforts go a long way toward protecting your credit standing and giving you more control over your financial future. For example, you could make it a goal to reduce overall balances by a specific amount or improve your utilization ratio by a certain percentage. Regularly measuring your progress makes it easier to stay motivated and financially sharp.

Bottom Line

A perfect all-round credit score, and the highest you can get, is 850. Very few people actually achieve this — in fact, it’s less than 2%, so getting there is almost as challenging as being among the top 1% of wealthiest people in the country.

On the other hand, striving for a better credit score is always beneficial, no matter where you’re starting from. If you’re looking for a new credit card to help you on that journey, see if you pre-qualify for a Credit One Bank offering, which doesn’t affect your score.